Resources Library

This is our central library for everything software. From explanatory pieces and short, insightful video, through to in-depth technical eBooks and our upcoming event schedule, if you have a topic you want to explore within software development, you’ll find it here.

Filter content by type, or by topic, to easily find what you’re looking for.

Mapping Client Data across Internal and External Systems

Collaborating with CID, a law firm’s team kick-started a data science project, working along business use cases and data products.

Building the Foundation to Enable a True Data-Driven Organization

Collaborating with CID, a professional services firm’s team kick-started a multi-year data fabric project.

Market Data Analytics as Power BI Self-Service

CID helped a healthcare firm shorten the time for new market data availability in self-service reporting systems.

Supporting Investor Attraction Outreach

Supporting the outreach of a state government by CID

Keeping Advisors Up-to-Date about their Clients

CID’s expertise in AI offers news processing, event detection, and entity mapping tailored to the international private bank’s needs.

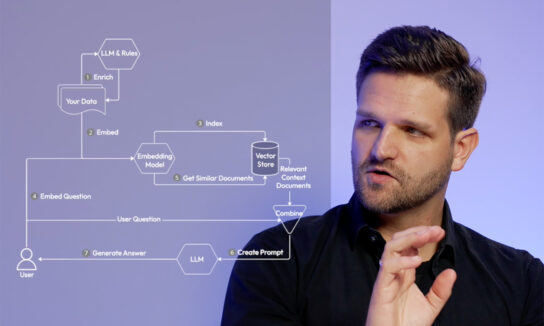

RAG – GenAI with your own data

Video: RAG – the key to improved, context-driven generative AI use without the need for expensive fine-tuning

MLOps: Optimizing the machine learning life cycle

Video: Unlocking the Power of Machine Learning (Part I)

RAG – More than a chatbot with your own data

Building upon basic RAG, Agentic RAG systems are poised to overhaul GenAI usage. But can the GenAI trust issue be solved?

Let’s talk

Have a vision but not sure exactly how to make it a reality? Let’s have a chat and see if our open, collaborative, expert approach can give you what you need to make a difference.

Contact us